When life throws unexpected expenses your way, finding immediate cash solutions can feel overwhelming. Fortunately, there are options like personal loans, but it’s essential to look in to their pros and cons in order to find the best fit for your needs. Here’s how you can secure fast cash while making informed decisions.

Understanding Personal Loans: Are They the Right Fit?

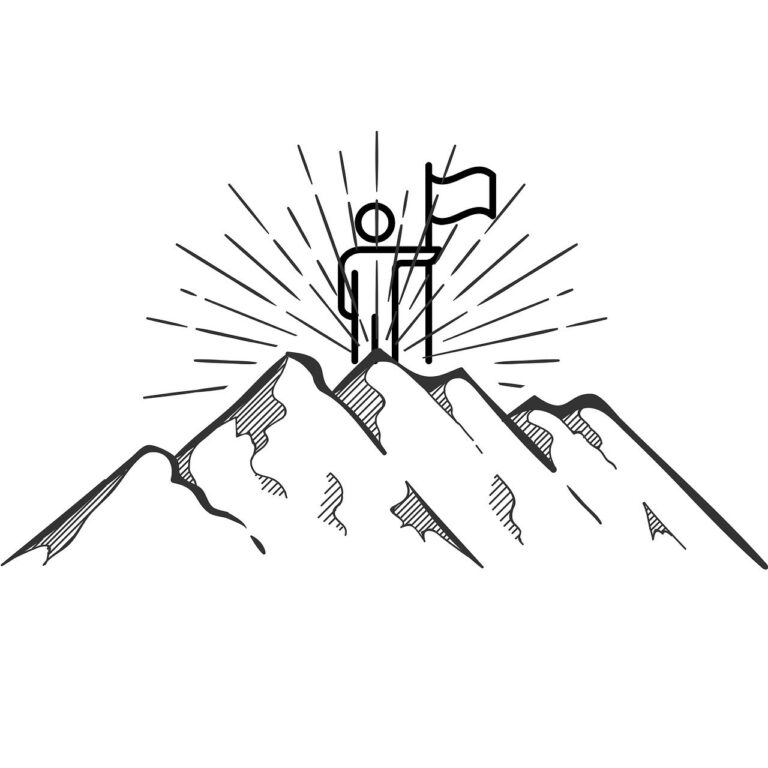

Personal loans can be a reliable way to access funds quickly. These loans come in two types: secured loans (this requires a collateral) and unsecured loans (this does not require a collateral). Unsecured loans are often the best option for quick cash, especially if you have a good credit score. Here are some

Key Points:

- Things that usually qualify as collateral in secured loans are valuables such as a car, jewelry, other assets, etc.,

- Unsecured loans rely on credit scores and lender criteria.

- Typical processing times for approved funds are that they can be deposited directly into your account within days.

Why Unsecured Loans Are Often the Safer Bet

While secured loans require offering up valuable assets, unsecured loans don’t put your belongings at risk. However, they might come with higher interest rates depending on your creditworthiness. Potentially other factors like employment, debts, and other finance metrics may be used to determine the rate you are approved for. Here are some

Key Points:

- Risks of secured loans: potential loss of assets if repayments are missed.

- Unsecured loans require no collateral, making them less risky but slightly costlier.

- Importance of reading terms and conditions carefully before agreeing to any loan. (Or Ask Questions!)

“Borrowing money is the easy part; repaying it requires careful planning.”

Why Banks Might Not Be the Best Option for Quick Loans

Banks are reputable but often have strict requirements, which might not make them the fastest option. They typically cater to borrowers with high credit scores and detailed documentation. Below there are pros and cons outlined so that it is easier to have a foundational overview of why banks are good and maybe not so good. Below, there are pros and cons outlined for the good and bad.

Pros:

- Physical branches for in-person assistance.

- Well established reputation and transparent reviews.

Cons:

- High credit score requirements.

- Higher interest rates and fees compared to alternatives.

Key Points:

- When do bank loans work best? Only if you qualify for competitive rates.

- Tips to improve credit score quickly for better approval chances.

Credit Unions: A Balanced Approach for Personal Loans

Credit unions often strike a middle ground with more lenient criteria and lower fees. However, please keep in mind that all credit unions are not the same but each will most likely require you to obtain a membership at their union first. Becoming a member is usually straightforward and inexpensive. Below I’ve outlined some key points to keep in mind for a better overview.

Key Points:

- Membership process: small deposit requirements.

- Lower interest rates and minimal fees compared to banks.

- Slightly slower loan processing times (up to 10 business days).

Online Lenders: Convenience at a Cost

Online lenders are fast and easy but may fall short in customer service. While rates and terms are often transparent, assistance can be limited if issues arise. If you need to find rates quickly and seamlessly so that you can compare to other lenders rates, then Online lender is a great choice as they are typically detailed with lending criteria online and in their advertisements. See key points outlined below for an overview to help with your thoughts.

Key Points:

- Quick application processes, accessible rates.

- Lack of in person support and potential communication delays.

- Scenarios where online lenders work best: when speed outweighs the need for face to face assistance.

“The convenience of online lenders is great – Until you need someone to pick up the phone”

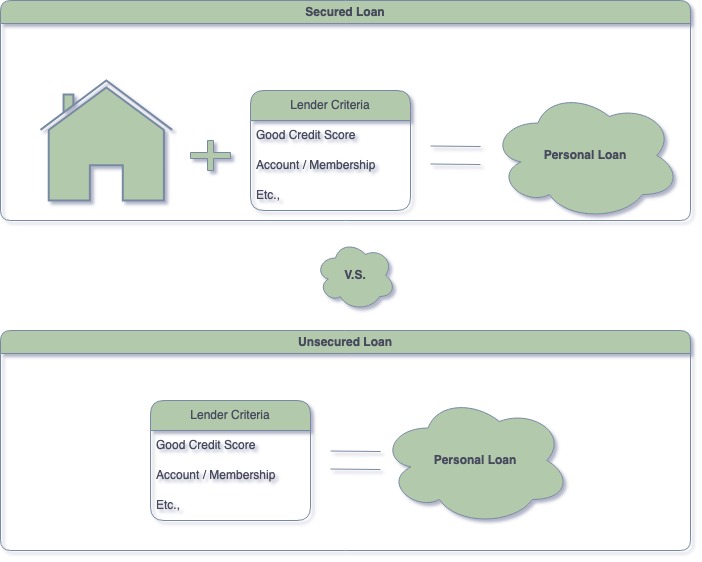

Build Financial Stability: Long Term Strategies to Avoid Emergencies

It is a great thing to have access to emergency cash places such as banks, credit unions, and online lenders. But it’s even greater to not be in this type of situation where you need assistance from outside entities that will ultimately want back their loaned money to you with extra. To reduce the likelihood of needing quick cash in the future, consider adopting these long-term financial habits:

Key Points:

- Start an emergency fund: Save a small amount consistently and resist the urge to dip into it.

- Lower expenses: Switch to budget-friendly services, such as insurance or utilities.

- Make purposeful purchases: Shop intentionally and consider second-hand or discount stores for essentials.

Honorable Mention – Gig Money

Gig work earns an honorable mention because opinions on it vary widely based on who is being asked about Gig money. Whether it’s an hourly wage job or a lump-sum agreement, gigs can be a fantastic way to earn quick cash. Depending on your location and season, consider offering home cleaning services to nearby neighborhoods or posting about a niche skill you have that others might find valuable. For example, if you are great at magic tricks, you could teach aspiring magicians looking to sharpen their craft or maybe perform at parties depending on how good the magic is of-course!

Keep in mind, however, that some niche gigs may attract individuals who also have limited funds. Be thoughtful about the time and effort you invest to ensure it’s worthwhile. Gig money is versatile and creative—just think outside the box and lean into your strengths!

“Small, consistent steps today can lead to big financial stability tomorrow”